georgia film tax credit requirements

Projects first certified by DECD on or. Instructions for Production Companies.

First passed in 2005 Georgias film tax credit provides an income tax credit to production companies that spend at least 500000 on qualified productions.

. Film television and digital entertainment tax credits of up to 30 percent create significant cost savings for companies producing feature films television series music videos and commercials as well as interactive games and animation. The base credit rate was raised to 20 in 2008 with an additional 10 for a qualified promotion of the state eg Georgia logo. Income Tax Credit Utilization Reports.

Beginning January 1 2021 mandatory film tax credit audits must be conducted before usage of the film tax credit. Diversity Management Satisfy diversity pay data requirements. How to File a Withholding Film Tax Return.

On average 1 of Georgia Film Tax credit can be purchased for 087 to 090. Prior to claiming any Film Tax Credit each new film video television or Interactive Entertainment product must be certified as meeting the guidelines and the intent of the Act. The estimated base investment or excess base investment in this state.

Projects certified on or after January 1 2023 are required to have a final tax certificate in order to use. GDOR requires the following. 159-1-1-01 Available Tax Credits For Film Video or Interactive Entertainment Production.

Claim Withholding reported on the G2-FP and the G2-FL. Production companies are required to withhold 6 Georgia income tax on all payments to loan-out companies for services performed in Georgia when getting the Georgia Film Tax Credit. Lee Thomas Deputy Commissioner.

This rule provides guidance concerning the application and qualification guidelines contained within the Georgia Entertainment Industry Investment Act hereinafter Act under OCGA. Answer Simple Questions About Your Life And We Do The Rest. FAQ for General Business Credits.

Georgia Tax Center Information Tax Credit Forms. Global tax credit and incentives solution. There are two separate credits made available under the Act.

An additional 10 credit can be obtained if the finished project includes a promotional logo provided by the state. Register for a Withholding Film Tax Account. A final tax certification is not required before January 1 2023 for productions seeking a 25M credit.

A Project Certification Requirement. 20 percent base transferable tax credit. Tax The Georgia film credit can offset Georgia state income tax.

The audit is requested through the Georgia Department of Revenue website GDOR and conducted on a first comefirst served basis. The base credit rate was raised to 20 in 2008 with an additional 10 for a qualified. To earn the 20 film tax credit the Georgia Department of Economic Development must certify the project more on this later.

159-1-1-03 Film Tax Credit Certification. There is a tiered system that is based on the estimated tax credit value. Of the film tax credit 18-03A was released earlier this month.

Offset up to 50 Corporate Income Tax Personal Income Tax Premium Tax Capital Stock and Franchise Tax and the Bank Shares Tax. Join our talent database. For example you could purchase 20000 of 2017 Georgia Entertainment Credits for 17400 resulting in an immediate savings of 2600.

Limited to one room per person. 500000 minimum spend to qualify. Central Casting Get found.

The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter. Qualifying Projects 20 tax credit is provided for companies that spend 500K or more on production and post production in Georgia.

The Department of Economic Development certification number. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. The film tax credit percentage amount either 20 percent or 30 percent.

Unused credits carryover for five years. The mandatory film tax credit audit is based on the date the production was first certified by the Department of Economic Development DECD and the credit amount according to the following schedule. Film Tax Credit Audits.

Qualified projects distribution must extend outside the state of Georgia and have a minimum of 500000 qualified in-state expenditures over a single tax year. No limits or caps on Georgia spend no sunset clause. Income Tax Letter Rulings.

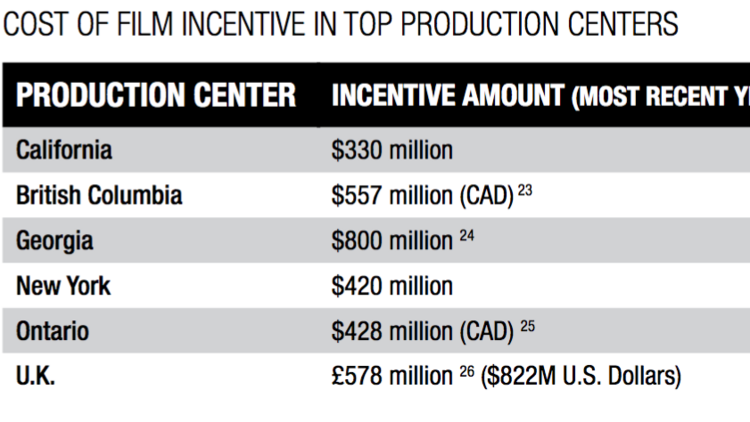

Third Party Bulk Filers add Access to a Withholding Film Tax Account. Georgias Entertainment Industry Investment Act provides a 20 percent tax credit for companies that spend 500000 or more on production and. The Georgia Entertainment Industry Investment Act provides the largest tax credit offered by Georgia and it is the most generous film incentive program in the nation with an estimated 915 million of tax credits generated during 20171 A production company that spends 500000 or more on qualified productions are eligible for a tax credit of.

No Tax Knowledge Needed. Eligible productions for the Georgia film tax credit include. File With Confidence Today.

GEORGIA FILM PRODUCTION TAX CREDIT GENERAL GUIDELINES 12142018 Housing - Hotels YESUp to the amount as set forth by the United States General Services Administration any excess must be included in the loanout companys or the persons income in order to be qualified. Statutorily Required Credit Report. Qualified Education Expense Tax Credit.

A tax certification is not required before January 1 2023 for credits of less than 125M. Housing - Private Residence YES. A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax returns.

Any amounts so withheld shall be deemed to have been withheld by the loan-out company on wages paid to its employees for services performed in Georgia. For over a decade and more than 975 million in transactions in the entertainment tax credit marketplace weve worked tirelessly to. Income Tax Credit Policy Bulletins.

Georgia Issues Film Tax Credit Guidance Addressing Georgia Vendor Requirements Production companies in Georgia who purchase or rent property from vendors located in Georgia may not be able to get film tax credits for the cost of obtaining that property if the vendor is really a conduit. About the Film Tax Credit First passed in 2005 Georgias film tax credit provides an income tax credit to production companies that spend at least 500000 on qualified productions. To see what film tax credits are offered across the country hover over the map.

How-To Directions for Film Tax Credit Withholding.

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Georgia No Longer No 1 In Feature Film Production Atlanta Business Chronicle

Gftcf Logo By Merdeka Logo Design Personal Logo Design Logo Design Contest

Essential Guide Georgia Film Tax Credits Wrapbook

Essential Guide Georgia Film Tax Credits Wrapbook

Film Television And Digital Entertainment Tax Credit Georgia Department Of Economic Development

The Bowery Went Down To Georgia Georgia Film Savannah Chat

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Essential Guide Georgia Film Tax Credits Wrapbook

Georgia Film Industry Posts Record Year After Blow Dealt By Covid

Essential Guide Georgia Film Tax Credits Wrapbook

Essential Guide Georgia Film Tax Credits Wrapbook

Pin On Attracting A Job Vision Board

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Film Incentives And Applications Georgia Department Of Economic Development