georgia ad valorem tax rv

Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later.

The New Title Ad Valorem Tax Tavt In Simple Terms Lake Lanier

If you are registering during the registration period for that vehicle you will need to pay the ad valorem tax due at this time.

. Credit is allowed in Florida for sales tax paid in Georgia on non. Georgia Tax Center Help Individual Income Taxes Register New Business. TAVT Annual Ad Valorem Specialty License Plates Dealers.

This tax is based on the value of the vehicle. We have since relocated up to Georgia and brought the RV with us. A reduction is made for the trade-in.

This calculator can estimate the tax due when you buy a vehicle. It has to fit into the same 10000 limit as your sales tax but if it does youll want to take it. Read more and use the calculators at.

The basis for ad valorem taxation is the fair market value of the property which is established January 1 of each year. A mill is 110 of 1 cent or 1 per 1000 of assessed value. Yes if applicable.

The TAVT rate will be lowered to 66 of the fair market value of the motor vehicle from 7. New residents to Georgia pay TAVT at a rate of 3 New Georgia Law effective July 1 2019. Instead the purchased vehicles are subject to a one-time title ad valorem tax TAVT.

Local state and federal government websites often end in gov. Andy ad valorem is Latin for according to value. If you are registering during the registration period for that vehicle you will need to pay the ad valorem tax due at this time.

Problem is theres a 7 ad valorem tax that will be assessed on our RV when we register it based on fair market value. The Georgia Department of Revenue assesses all vehicle values for tax purposes each year. The tax is levied on the assessed value of the property which by law is established at 40 of the fair market.

Vehicles purchased on or after March 1 2013. The New Title Ad Valorem Tax Tavt In Simple Terms Lake Lanier Hier sollte eine Beschreibung angezeigt werden diese Seite lässt dies jedoch nicht zu. Georgia ad valorem tax rv Monday March 14 2022 Edit.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. 2019 Motor Vehicle Ad Valorem RAVT Assessment Manual 759 MB 2018 Motor Vehicle Ad Valorem RAVT Assessment Manual 71 MB 2017 Motor Vehicle Ad Valorem RAVT Assessment Manual 637 MB 2016 Motor Vehicle Ad Valorem RAVT Assessment Manual 614 MB 2015 Motor Vehicle Ad Valorem RAVT Assessment Manual 672 MB. As of 2018 residents in most Georgia counties pay a one-time 7 percent ad valorem tax on these vehicles at the time of purchase.

Is the county name decal required. The full title ad valorem tax or continue to pay the annual ad valorem tax under the old system. In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later.

Valid drivers license or picture ID. Georgia ad valorem tax 2021 Saturday June 4 2022 Edit. For the answer to this question we consulted the Georgia Department of Revenue.

Its based on the value of the vehicle. The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those. Generally any motor vehicle purchased on or after March 1 2013 and titled in Georgia is exempt from sales and use tax and the.

Georgia Listed As A Tax Friendly State For Retirees The New Title Ad Valorem Tax Tavt In Simple Terms Lake Lanier. We are excited to implement Senate Bill 65 which ultimately reduces the. Ad valorem tax more commonly known as property tax is a large source of revenue for governments in Georgia.

Having done this we just went get our 2000 tag and were hit with 5000 Highway Impact fee which will be an annual fee. Taking a standard. Each vehicle you have registered in georgia is subject to either ad valorem tax or title ad valorem tax tavt.

Ivylog Blairsville GA and WPB FL. In addition if you purchase and title a vehicle between January 1 2012 and March 1 2013 you may be eligible to opt-in to the new title ad valorem tax. The state of Georgia charges this tax annually on personal property cars trucks motorcycles campers trailers.

The New Title Ad Valorem Tax Tavt In Simple Terms Lake Lanier Georgia Used Car Sales Tax Fees 2. Ad valorem tax or use tax deduction. At a market value of 60k-80k that means 4200 - 5600 out of pocket on a vehicle weve already paid sales tax for.

06-10-2014 0725 PM 4. Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia. Where do the funds go.

Accordingly the fair market value for a used motor vehicle for purposes of TAVT will generally be the same as the value that was used in the old annual ad valorem tax system. Annual Special Tag Fee. Beginning March 1 2013 the Georgia tax rules applicable to motor vehicles changed significantly.

When registering a RV in Georgia be prepared to pay the total ad valorem tax up front. The TAVT is collected by the county tax commissioner before a new title is issued and the vehicle is. RV sales tax ad valorem is actually 7.

I guess since the rv is based in Georgia youre getting the charge. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. Assessments are by law based upon 40 of the fair market value for your vehicle.

Some states like Massachusetts and Georgia apply a use tax to cars boats and RVs. Ad Valorem Tax Required. Vehicles purchased on or after march 1 2013 and titled in georgia are subject to title ad valorem tax tavt and are exempt from sales and use tax and.

The law readsHighway Impact Fees - all vehicles in the following weight classes will a. How does TAVT impact vehicles that are leased. Before sharing sensitive or personal information make sure youre on an official state website.

Owners of vehicles that fit this category can use the DORs Title Ad Valorem Tax Calculator tool to calculate their. This value is calculated by averaging the current wholesale and retail values of the motor vehicle pursuant to OCGA. If the vehicle is currently in the TAVT system the family member can pay a reduced TAVT rate of 5 of the fair market value of the vehicle.

Some states like Massachusetts and Georgia apply a use tax to cars boats and RVs. Georgia Department of Revenue. Ad valorem tax may be due depending upon when you the primary owner - owner shown first on your vehicles title or registration certificate became a Georgia resident and.

Georgia requires minimum-liability insurance on all motor vehicles. Vehicles purchased on or after March 1 2013 and titled in Georgia are exempt from sales and use tax and the annual ad valorem tax ie. When we publish the millage rate we are describing the number of mills.

The cutoff year for reduced TAVT rate 1 for older vehicles changed to 1989 so the reduced rate applies to any person who purchases a 1963 through 1989 model year motor vehicle. You only pay this tax one time. Ad Valorem Tax Overview And Guide.

You pay it upfront when you get your tags but its deductible on your Schedule A. Rv sales tax ad valorem is actually 7. Instead these vehicles will be subject to a new one-time title ad valorem tax that is based on the value of the vehicle.

The family member who is titling the vehicle is subject to a 05 title ad valorem tax.

Georgia Taxes Page 2 Irv2 Forums

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Vehicle Taxes Dekalb Tax Commissioner

Georgia Used Car Sales Tax Fees

![]()

Georgia New Car Sales Tax Calculator

Georgia Motor Vehicle Ad Valorem Assessment Manual

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Vehicle Taxes Dekalb Tax Commissioner

Sales Tax On Cars And Vehicles In Georgia

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Amazing Maps

Georgia Sales Tax Small Business Guide Truic

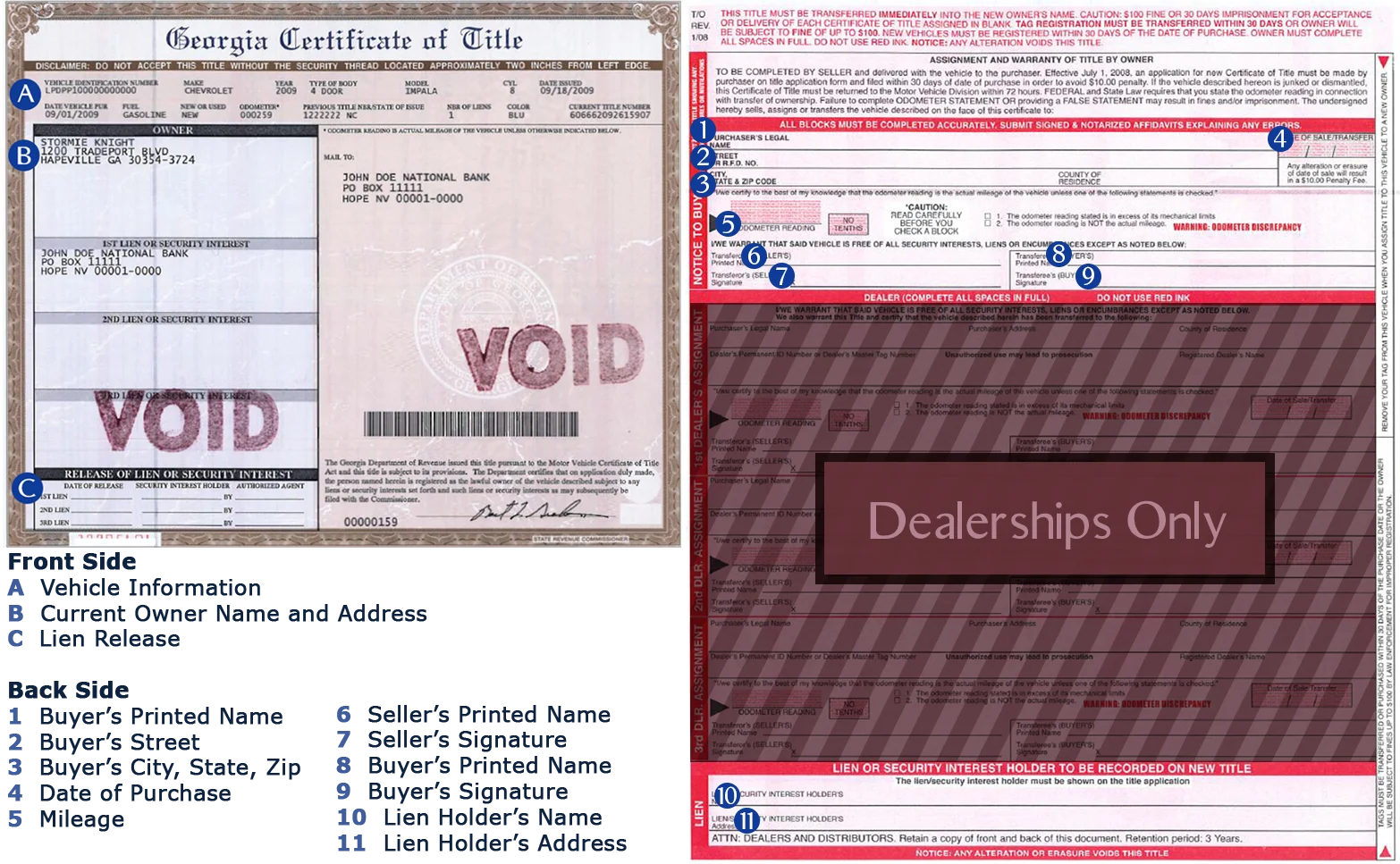

Titling A Vehicle Cobb Mvd Cobb County Tax Commissioner

Motor Vehicle Division Georgia Department Of Revenue

Vehicle Taxes Dekalb Tax Commissioner

Tax Commissioner Camden County Ga Official Website

15 Walnut Ln Ne Cartersville Ga 30121 Mls 6766385 Coldwell Banker Cartersville Real Estate Services Coldwell Banker